The entire nation is talking about it, we at Three Sixty° are sick of hearing about it, there isn’t going to be a diabolical crash, our property fundamentals are sound, it simply cannot happen.

Mortgage arrears are lower than this time last year, unemployment is low, interest rates are low and potentially going lower, inbound migration is high, economic indicators are strong...this is an artificial and manufactured slow-down, a direct result of the Hayne Royal Commission into the banking and finance sector which has been dragging on for 10 months but the end is in sight.

The market for our residential projects has felt the effects of the Royal Commission, as has the market for all items reliant on consumer finance, ie established housing stock and cars. Essentially all off-plan purchasers, excluding some downsizers, require banking liquidity in some form and the result is affordability at 2017 prices has become an issue.

So how does that relate to site selection?

BE FIRM ON YOUR TARGET MARKET AND WORK BACKWARDS

In an increasingly complex real estate market comprising infinite sub-markets, developers must during the DD, fully understand who the buyer type is.

Without question the preferred target market is the owner occupier, they have greater financing power and some have the benefit of trading in a large family home. So what’s the catch? They’re incredibly 'hook motivated', spoilt for choice and often very slow to act. In many cases it’s the last ever real estate purchase.

WHERE ARE THEY COMING FROM?

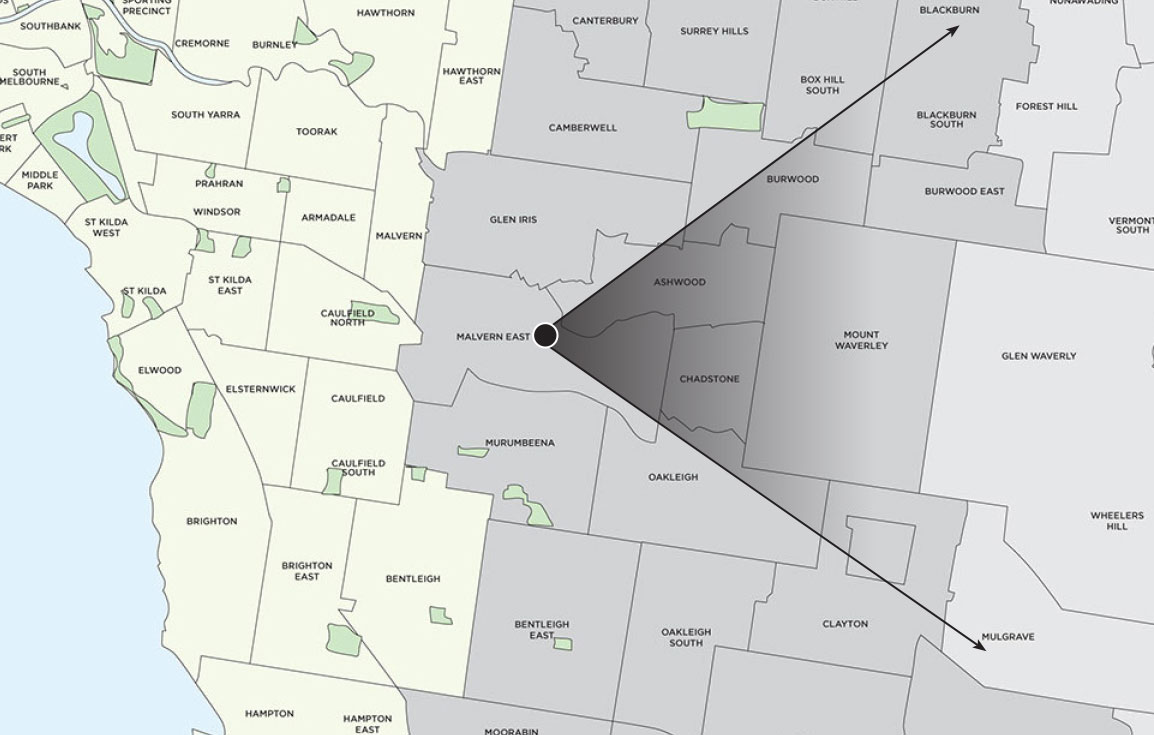

Many of our successful apartment and townhouse projects have seen buyer pools originate from a ‘geographic fan’ 5-10km from site.

For example our recent Hedgeley project in Malvern East saw the below owner occupier pattern, many purchasers saw the status increase from a Malvern address. The theory largely holds in all directions from the CBD.

WHAT ARE THE HOOKS?

The hooks are many and are often buyer specific and usually revolve around;

- Particular schooling zone

- Close walking proximity to café, transport, workplace or coastline amenity

- Access to perpetual CBD or water views

- Entry to a status suburb ie Melbourne’s inner East and South East

- Genuine irreplaceable locations

- Genuine luxury finishes

In most cases buyers view the benefits of the hook as a trade-off for dwelling size vs' the surrounding established, larger more expensive housing stock.

Developers must be satisfied and understand the underlying hooks prior to committing to a site.

Remember the golden rule - if owner occupiers are willing to purchase within a development investors will also…..but not vice versa.

SQUARE PEG ROUND HOLE?

Every day as a residential project marketing firm we are presented apartment & townhouse projects with incredible owner occupier appeal and some without. So what are the main Achillies Heels?

- 20-30min+ walk to any cafe, shopping or transport amenity

- Overdeveloped locations (ie Forrest Hill South Yarra & City Rd Southbank et al)

- Heavy intersections & arterial roads

- Impaired floorplan layouts and aspects

- Reliance on car stackers

NO HOOK FACTOR?

Maslow described shelter as a primary human need, so the theory holds that will always be demand for real estate however eventually the final hook becomes price, but that’s ok!

I have the following tips for sites that may have a great yield of dwellings however lack hook factor;

- Strike feasibility revenue assumptions based on very competitive unit pricing

- Economic level of finish (but not economic appearance)

- Creative but low cost residents amenity

- Generous unit sizes

We regularly devise Investor targeted strategies to purchaser this stock however the investor is generally currently chasing lower price points.

WASHING UP OR OUT TO DRY?

Beauty will always remain in the eye of the prospective purchaser and not the myriad of industry consultants so always seek advice from a broad pool on unbiased but experienced opinions prior to committing to site.

In short simply do not buy a site without hook factor unless you have a very healthy development margin buffer.

If you have any questions on current or prospective development site please contact Three Sixty Property Group today.

TIM ALLEN

P: 0422 043 443